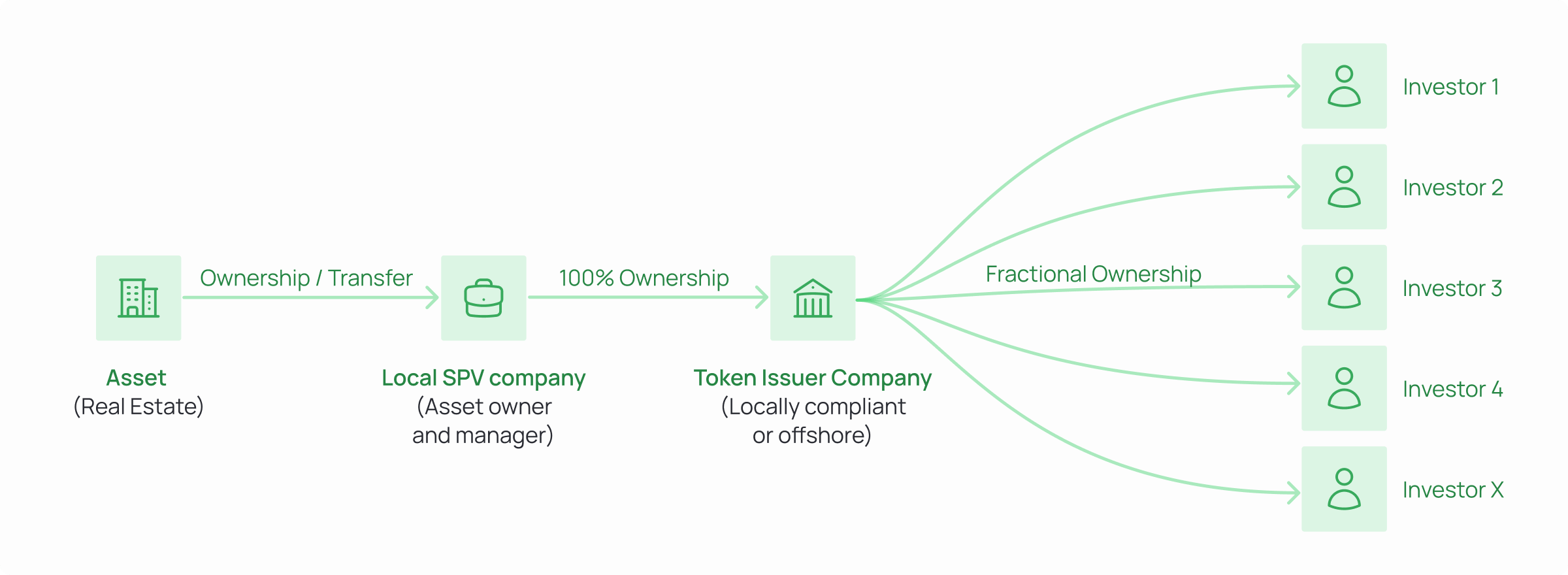

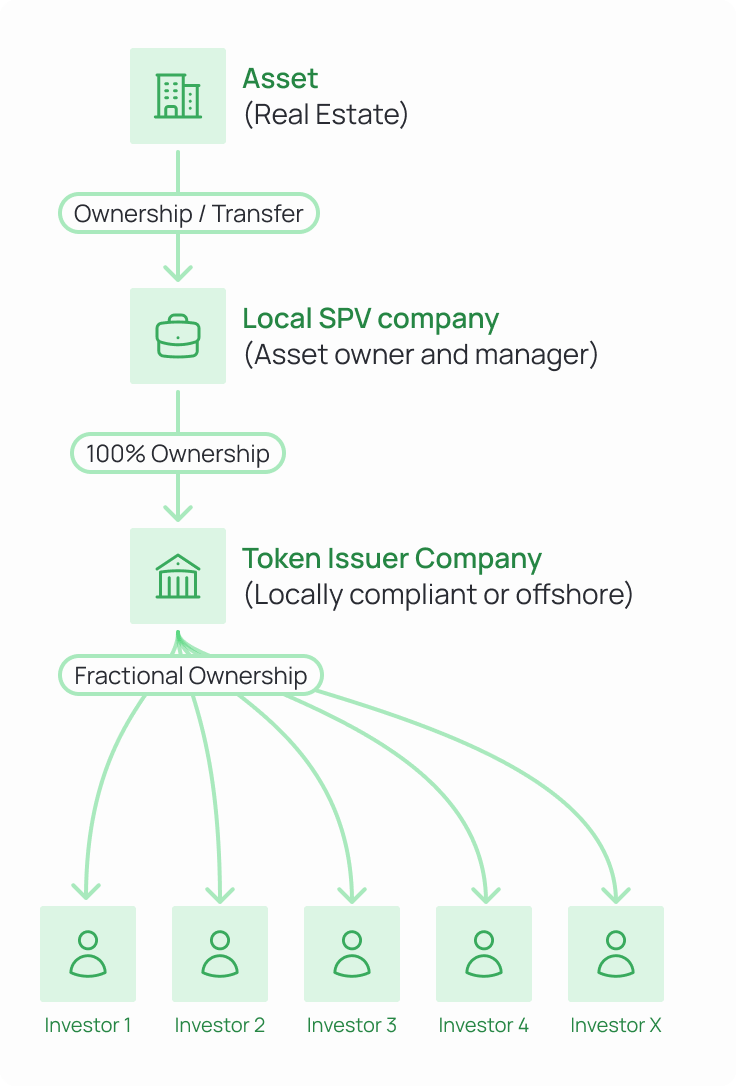

How Real Estate Tokenization Works

Digitize your assets, unlock liquidity, and sell fractional shares — with compliance and transparency at every step

Step-by-Step Workflow

1

Structure the Asset

Set up an SPV or use your existing entity. Define the share of equity or income you want to tokenize.

2

Digitize & Tokenize

Your property becomes secure digital shares on blockchain. Tokenomics, smart contracts, and compliance layers are applied.

3

Launch the Offering

Go live with a fully branded investor dashboard. Integrated KYC/AML, crypto & fiat payments.

4

Manage & Distribute

Monitor performance in real time. Automate payouts in stablecoins, handle buybacks, and maintain investor relations. Automated returns and full transparency build long-term trust