White Label Platform for Real Estate Tokenization

Operate a fully compliant real estate tokenization business on your own domain — with tools for asset issuance, investor management, and automated transactions

Book a Free DemoBuilt by experts in blockchain, finance, and real estate with 10+ years of experience

Built by experts in blockchain, finance, and real estate with 10+ years of experience

Backed by Market Growth

$16T

Tokenization of all illiquid assets

Estimated to reach $16 trillion by 2030 — around 10% of global GDP

BCG / World Economic Forum$4T

Broader RWA Tokenization Market

Expected to exceed $4 trillion by 2035, up from less than $0.3T in 2024

Deloitte$18B+

Already Tokenized Today

By early 2025, over $18 billion in real-world assets are tokenized on public blockchains

Forbes

Why industry leaders choose Tokenizer.Estate

Because we go beyond a platform: we give you full control over your assets and investors

Your Brand

Launch your own branded platform. Full ownership, full control — no middlemen

Global Compliance

Expand without borders. Built-in legal clarity for any market

Flawless Automation

Smart contracts do the work — ownership, payouts, and transparency on autopilot

Secure Growth

Scale your business with confidence — your assets are always protected

Solutions Designed for Your Success

We support everyone from Real estate owner to Sovereign Funds

Property Developers

Scale your investor reach with fractional ownership and dynamic pricing tools

Learn more

Real Estate Firms

Offer innovative investment products with fractional ownership, automated payouts, and global KYC/AML onboarding

Learn more

High-Net-Worth Individuals

Gain liquidity and diversification with partial tokenization, while maintaining full control of your assets

Learn more

Real Estate Investment Funds

Broaden your investor base with retail access, automated dividends, and transparent blockchain reporting

Learn more

Financial Institutions

Enable compliant digital products with automated operations and full control over capital flows

Learn more

Cannot Find yourself here?

Share your idea — our experts may adapt a compliant model for your market

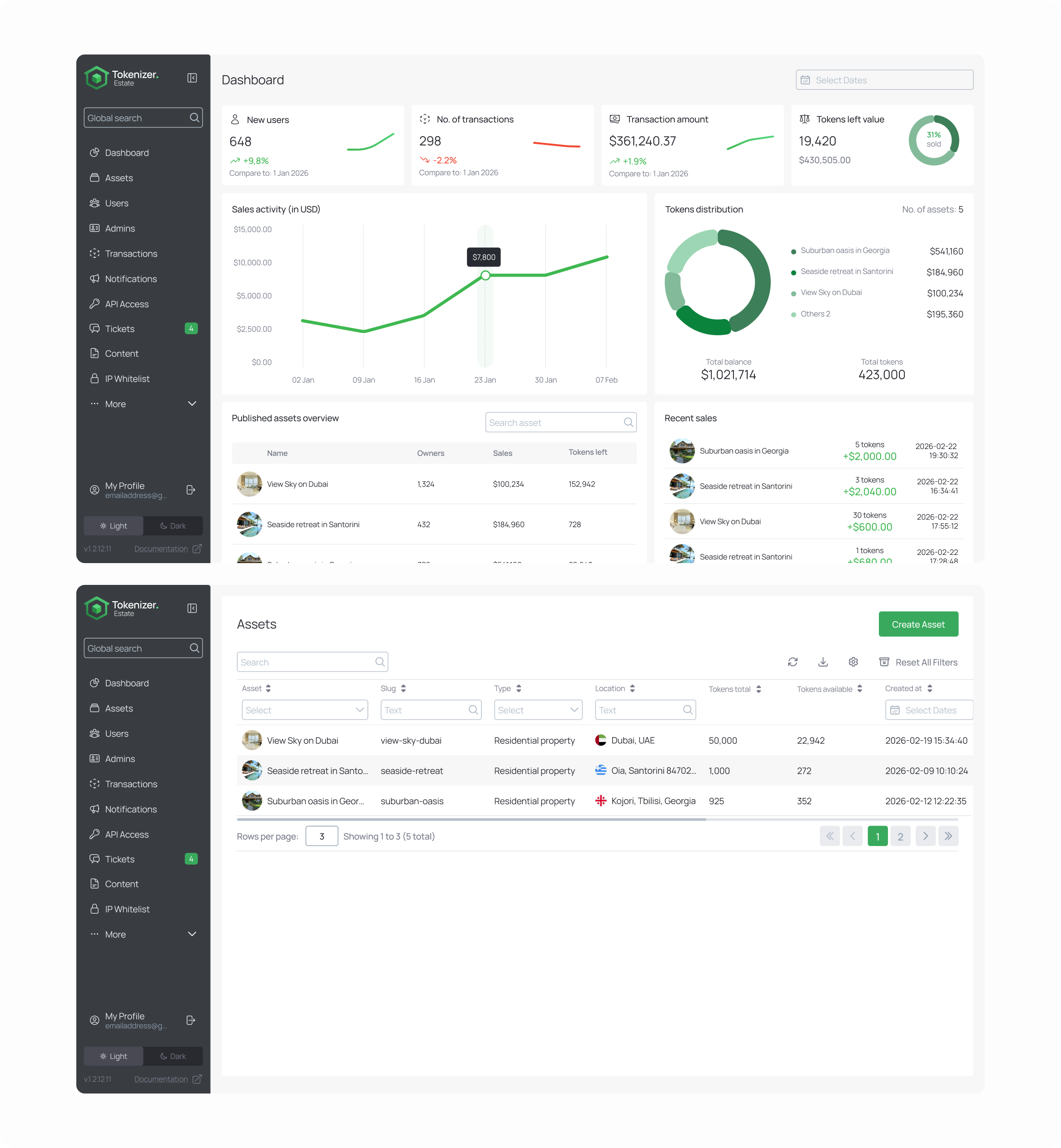

Back office Asset Management

The first fully turnkey solution for real estate tokenization — combining legal, technology, and compliance in one platform

Portfolio management & Analytics

Real-time data and transaction monitoring

Direct investor request handling and community coordination

Fully secured

Role-based access

Auditable logs of all actions

Strict protocols for any risk-related events

Secure storage of private keys on separate infrastructure

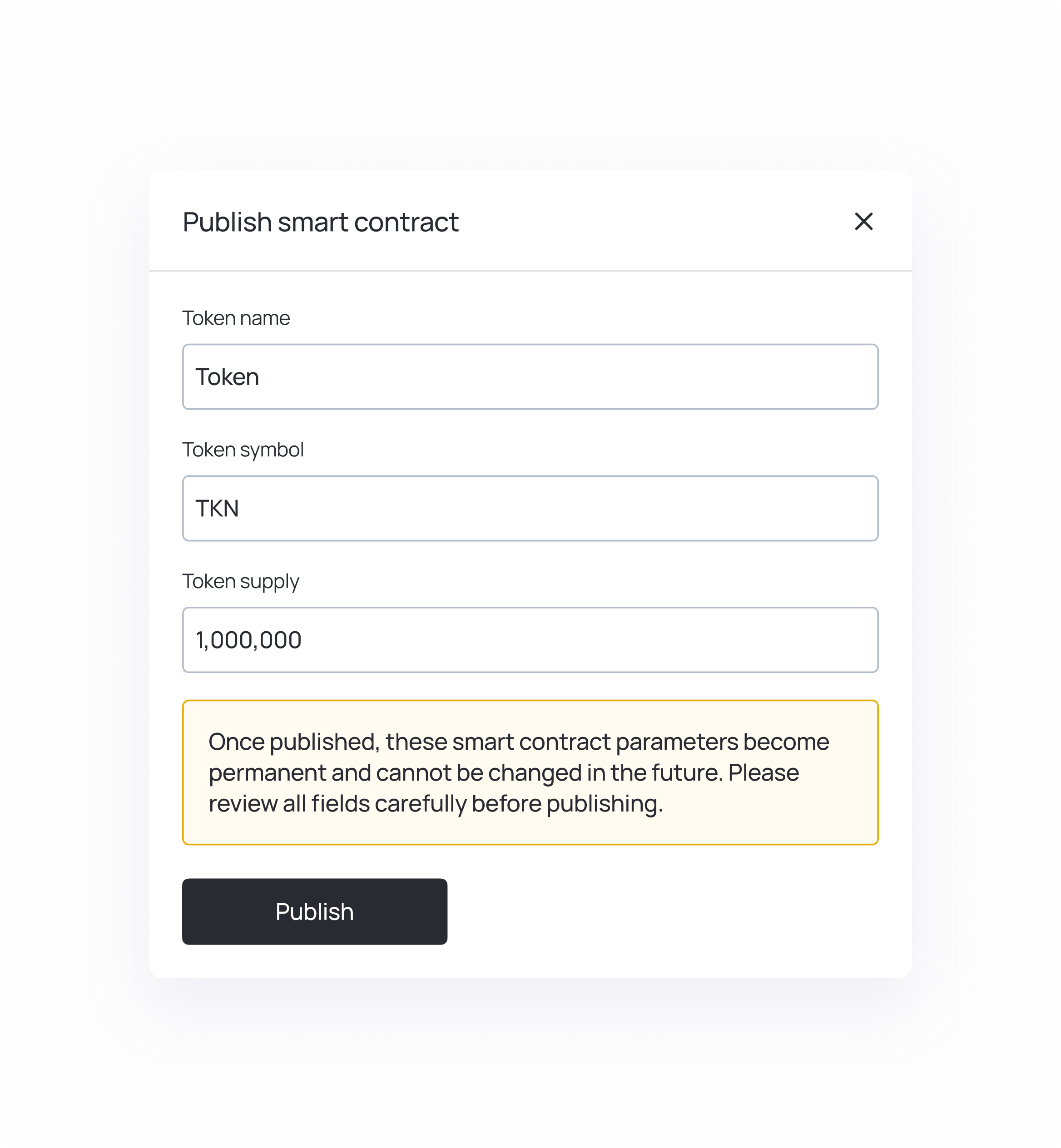

Blockchain-based Smart Contract Generator — No need to look for Solidity developers anymore

Manage token sale stages with a few clicks

Audited and secure smart contracts for various use cases, ready for efficient deployment

Automate dividend distribution and token redemption

Token developed on the ERC-20 based token launched on EVM-compatible blockchain and customized according to tokenization model

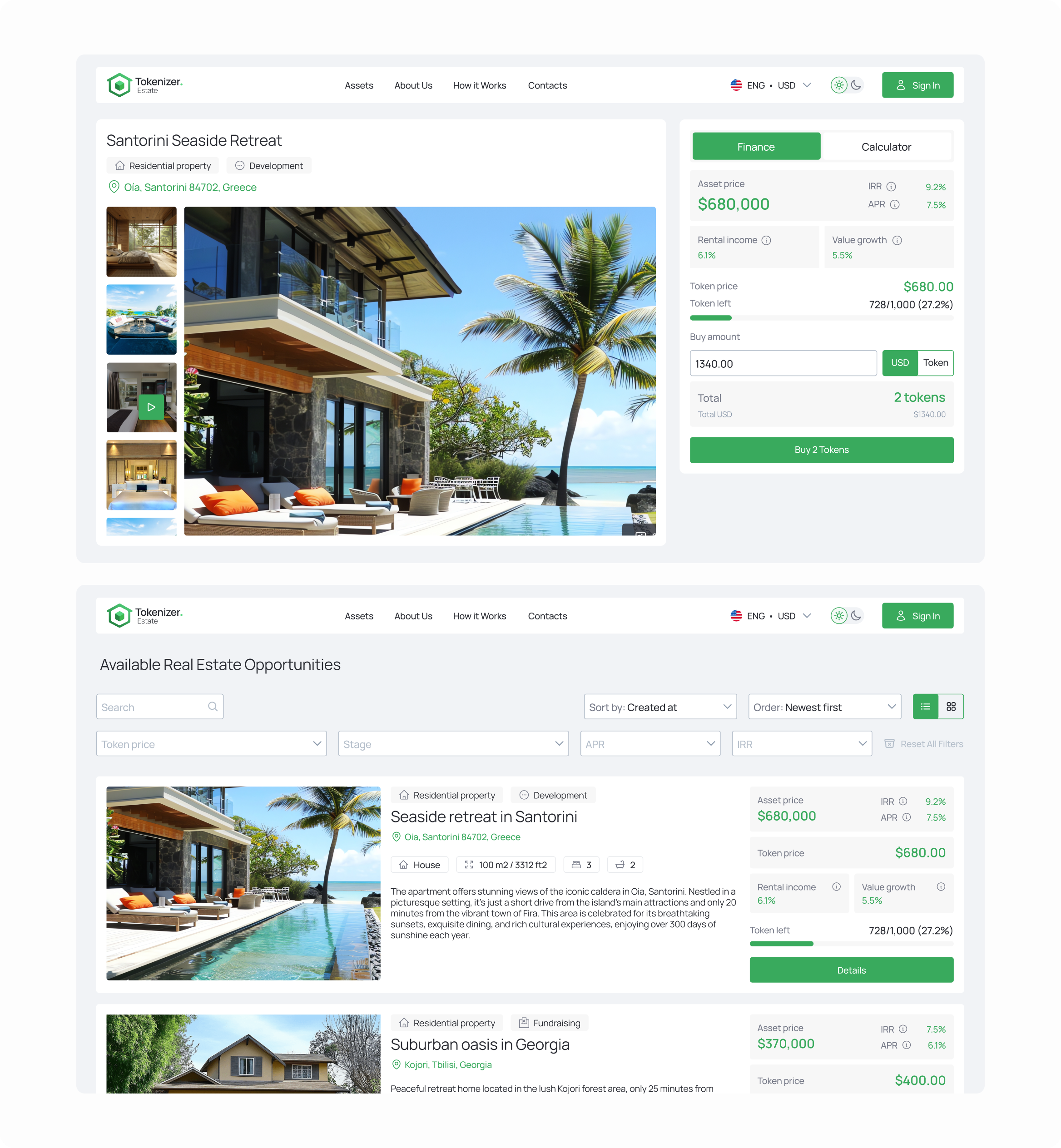

User-friendly Investor Dashboard

Fully customizable solution — Branded for your company

for a conversion focused investor experience

Configure your Token Sale — as easy as setting up an online store

Customized dashboard — for user friendly secure experience

Redemption interface — for buy back or cash options

Integrations with Payment system providers and crypto payments

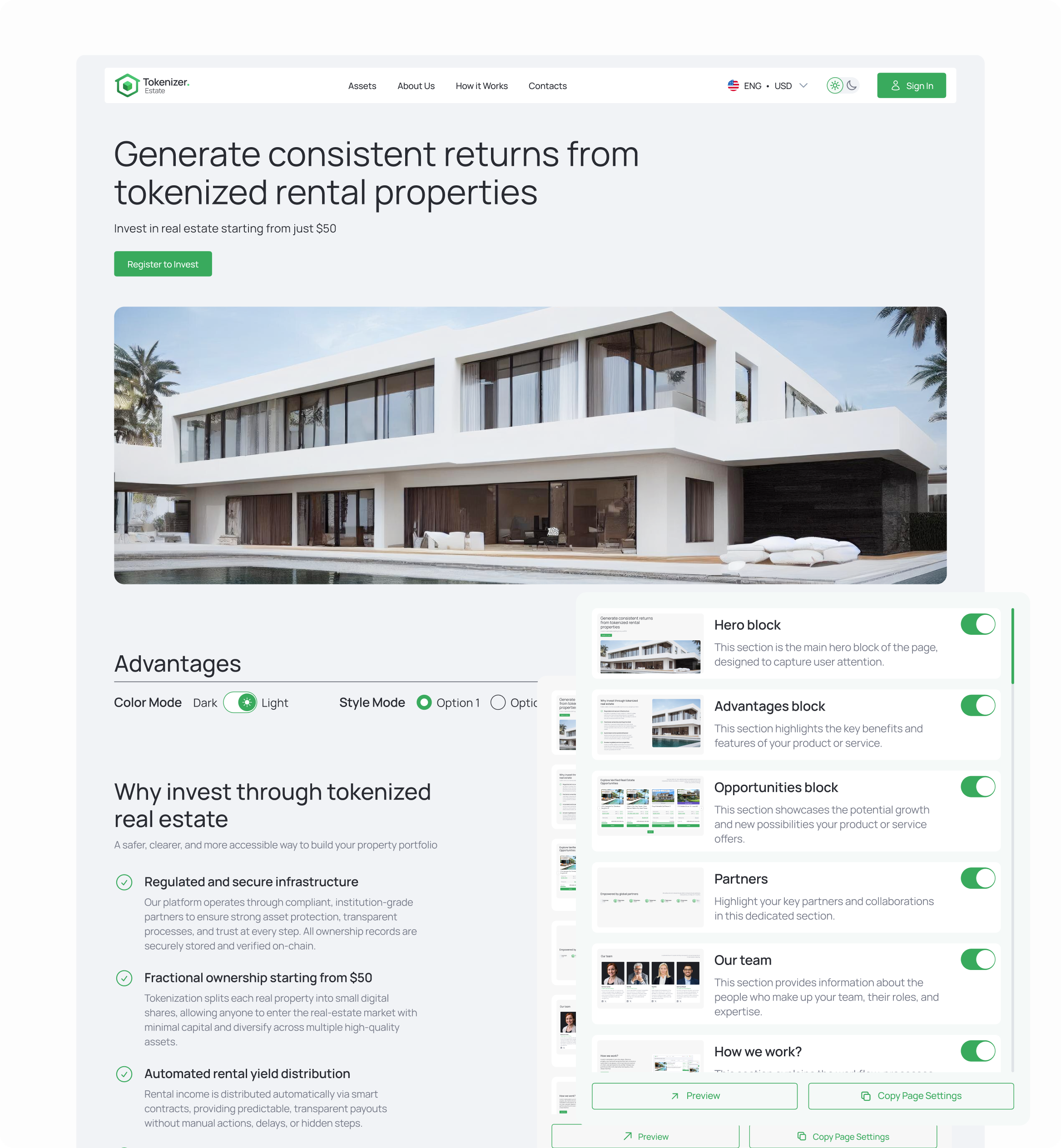

Custom projectLanding Page

Easy to use website builder module for dedicated project landing page

Optimized for SEO

30+ ready to use custom blocks

Light and Dark mode

Global Jurisdictional Coverage

Every market has its own rules. We've already built the structures to make tokenization work — from Europe to Asia to the Middle East. Launch with confidence, wherever your investors are